Personalise your digital banking solutions

Transform your banking approach with a personalized touch. Leverage real-time customer insights to offer tailored solutions and add unmatched value.

The Problem

Traditional digital banking applications may not have access to a wide range of financial data from different bank accounts and services, making it difficult for customers to get a complete view of their finances. This can lead to confusion, errors, and lack of control over their finances.

The Solution

Digital Banking applications enabled through our Banking API use real-time financial data from a variety of bank accounts and services to provide customers with a more comprehensive view of their finances. This allows them to easily track their spending, set budgets, and make more informed or automated financial decisions.

Products and Benefits

Balances

Check your user’s overall balance in real time

Account verifications

Confirm a user’s identity instantly

Transactions

Understand a user's spending by seeing their transactions

Income

Verify your user’s income

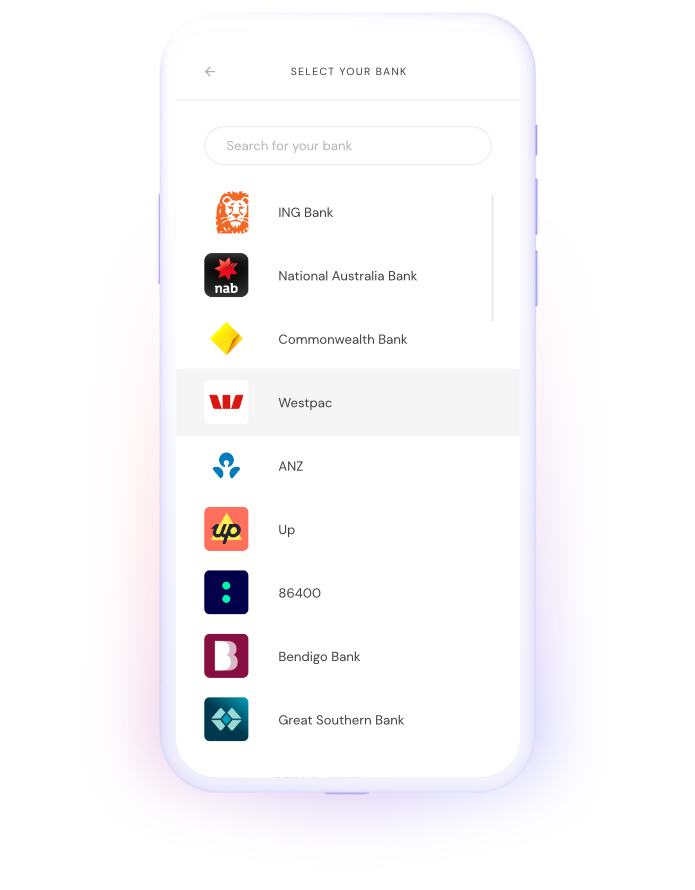

How it works

1

Get Consent

We’ll ask the user if they agree to share their banking data. The user will then select the data they wish to share, and for how long it will be shared for.

2

Authentication

Upon consent the user will authenticate into any bank of their choice simply using a biometric scan or a phone number and verification code. No login credentials will be collected.

3

Fiskil collects information

Fiskil collects, cleans and aggregates the user’s information fetched from the bank. Even if your user collects from multiple banks, we will always standardise and make sense of the data.