Create the future of accounting with Open Banking

Simplify and secure your data collection process by directly accessing bank information, improve accuracy of reconciliation and gain instant insight into cash flow with real-time visibility.

The Problem

Traditional accounting applications rely on manual data entry and outdated methods of information retrieval. This leads to errors, wasted time, and a lack of real-time visibility into financial information.

The Solution

Accounting applications that utilize Open Banking allow for seamless data integration and real-time updates. This leads to increased accuracy, efficiency, and a better understanding of financial health. With Open Banking, you can streamline your accounting process and make informed business decisions with real-time financial data.

Products and Benefits

Balances

Check your user’s overall balance in real time

Account verifications

Confirm a user’s identity instantly

Transactions

Understand a user's spending by seeing their transactions

Income

Verify your user’s income

How it works

1

Get Consent

We’ll ask the user if they agree to share their banking data. The user will then select the data they wish to share, and for how long it will be shared for.

2

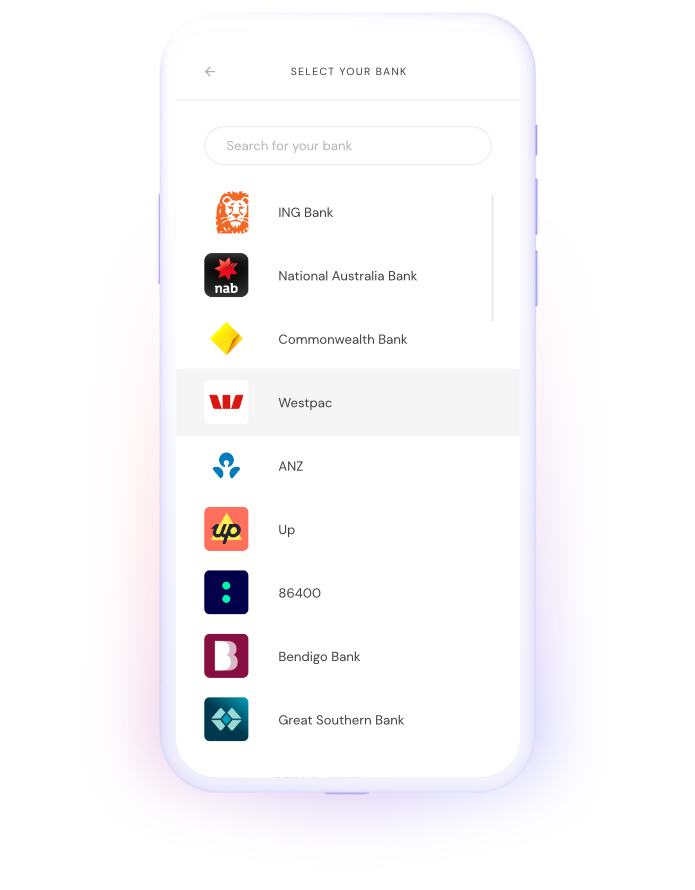

Authentication

Upon consent the user will authenticate into any bank of their choice simply using a biometric scan or a phone number and verification code. No login credentials will be collected.

3

Fiskil collects information

Fiskil collects, cleans and aggregates the user’s information fetched from the bank. Even if your user collects from multiple banks, we will always standardise and make sense of the data.